TAX REFORM 2026: NEW WITHHOLDING RULES FOR SELLERS ON DIGITAL PLATFORMS

Dec 8, 2025

For all individuals and legal entities whose business model relies on sales through platforms such as Amazon, Mercado Libre, and TikTok Shop in Mexico, it is essential to note that the Federal Revenue Law (LIF) 2026 introduces significant changes that will directly impact cash flow, as platforms will apply new mandatory tax withholdings on each transaction.

Effective January 1, 2026, a unified withholding regime will apply to taxpayers who generate income through digital platforms. These changes affect the withholding of Income Tax (ISR), Value Added Tax (VAT), and the reporting obligations required from both platform operators and sellers offering goods or services.

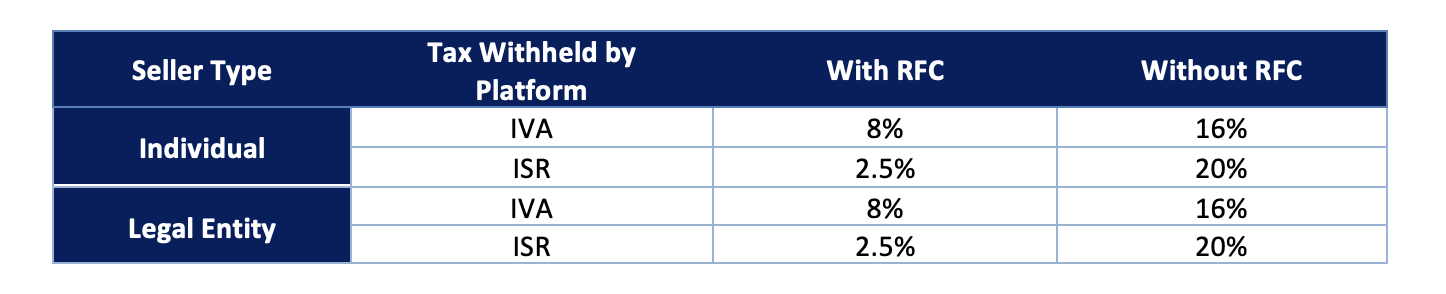

The new withholding rates will operate as follows:

The 2026 Federal Revenue Law establishes that all taxable operations carried out through digital platforms will be subject to a single 2.5% ISR withholding rate, replacing the progressive rates previously in effect. However, if a seller does not provide a valid Federal Taxpayer Registry (RFC), the applicable ISR withholding increases to 20%, making it essential to:

- Register a valid RFC

- Maintain an updated Tax Status Certificate

- Provide this information directly to the platform

In Mexico, the general VAT rate is 16% for taxable goods and services. However, platforms do not withhold the full VAT amount; instead, they retain a portion:

- If the seller has an RFC, the platform withholds 8%, equivalent to 50% of the total VAT (16%).

- If the seller does not provide an RFC, the platform withholds 16%, which represents 100% of the applicable VAT.

This means that the platform retains only part of the VAT, but sellers remain responsible for determining and paying any remaining tax obligations depending on their fiscal regime.

Because withholdings are applied automatically on every sale:

- Sellers receive only the net amount after VAT and ISR withholdings

- Platforms remit the withheld taxes directly to the Mexican Tax Authority (SAT)

For businesses whose primary revenue stream depends on these platforms, this model may significantly reduce monthly cash flow.

The reform also strengthens compliance requirements for platform operators, including enhanced reporting to the SAT on transaction amounts, user identity, and the nature of each operation. In cross-border transactions, or when payments are made to foreign accounts, the law requires platforms to withhold up to 100% of the applicable tax, substantially increasing operational risk when automated controls are not in place.

Given these significant changes, the new regime demands immediate internal adjustments. Operating without an RFC or without updated tax documentation may double the withholding burden and severely affect liquidity. For businesses dependent on digital platforms, understanding and adapting to this framework is essential to avoid financial and compliance risks.

Taxpayers will need to review and adjust internal processes such as:

- Tax identification and RFC updates

- Calculation and reconciliation of withholdings

- Billing systems and invoicing workflows

- Data integration and traceability

- Internal contracts and digital operation policies

Failing to do so may lead to fiscal contingencies and adverse cash-flow impacts.

How AS Consulting Group (ASCG) Can Support You

At ASCG, we can help you:

- Assess the financial impact of the reform

- Adjust your billing and withholding processes

- Prepare automated reconciliation and reporting tools

- Implement control systems for digital platforms

- Ensure full compliance with the 2026 tax framework

If you would like a personalized analysis session for your company or digital platform, we would be pleased to assist you.